Guide To Giving In The Workplace

Each year, billions of dollars are donated to America's charities

through workplace giving campaigns. Workplace giving is an easy and

efficient way to make tax-deductible donations to charities through

payroll contributions. Together with your company, you can work to

benefit your community by providing a much-needed stream of revenue to

charities. Chances are that if you work at a corporation or for the

federal government, you've had the opportunity to participate in one of

these programs.

While workplace giving was designed to improve America's charities'

efficiencies, benefits exist for both the employee and participating

charity. For the employee, these programs offer the convenience of

automatic payroll deductions without losing the tax benefits of

charitable giving. Since employers often match employee contributions,

workplace giving provides the employee with the opportunity to directly

influence their company's philanthropic endeavors. For the charity, even

a small pledge from an employee makes an impact when it is increased by

the employer's matching funds.

Charity Navigator, America's largest evaluator of charities, offers the

following 6 tips as a guide for employees who donate through workplace

giving programs.

1. Examine your values to determine which causes you want to support.

Workplace giving campaigns are user-friendly in part because they offer lots of choices. Employees have the option to contribute to all the participating charities or to designate their donation to specific charities. Therefore, before you participate in your employer's workplace giving campaign, you'll need to reflect on the issues you feel are most crucial. Whether you're concerned about the environment and believe the ocean needs to be cleaned up, or worried about the well-being of individuals in your community and want to support a local food bank, you should have plenty of choices that reflect your personal beliefs and values.

Workplace giving campaigns are user-friendly in part because they offer lots of choices. Employees have the option to contribute to all the participating charities or to designate their donation to specific charities. Therefore, before you participate in your employer's workplace giving campaign, you'll need to reflect on the issues you feel are most crucial. Whether you're concerned about the environment and believe the ocean needs to be cleaned up, or worried about the well-being of individuals in your community and want to support a local food bank, you should have plenty of choices that reflect your personal beliefs and values.

2. Review your personal finances to determine how much you can afford to give.

Once you've honed in on your charitable interests, you'll need to review your personal finances and set some giving goals. In general, it is estimated that average annual giving is 3.2% of income. Apply this percentage to your annual income and see if you are comfortable with that level of giving. Even better, break it down per pay period so you'll know exactly how much will be deducted from each paycheck. You might be surprised to find out you can afford to give more than you thought.

Once you've honed in on your charitable interests, you'll need to review your personal finances and set some giving goals. In general, it is estimated that average annual giving is 3.2% of income. Apply this percentage to your annual income and see if you are comfortable with that level of giving. Even better, break it down per pay period so you'll know exactly how much will be deducted from each paycheck. You might be surprised to find out you can afford to give more than you thought.

After you've calculated how much to contribute, you'll need to remember

a few rules in order to maximize the tax benefits of your gift. Payroll

deduction is convenient in that you do not need an acknowledgement from

the charity to claim your tax deduction. There is however one exception

to this rule. If you contribute $250 or more from a single paycheck,

then you must prove to the IRS that you (a) made the donation and (b)

you didn't receive anything in return for that donation. Simply keeping a

copy of your pay stub fulfills the first requirement. To comply with

the second, you'll need a pledge card or other documentation from the

charity specifically stating that you did not receive any goods or

services in return for your gift. If you need some help to determine the

level of giving right for you based on the tax benefits of giving,

access Charity Navigator's giving calculator.

3. Learn how the participating charities were pre-screened and back it up with your own research.

Not all workplace giving campaigns use the same criteria for selecting charities. Some simply compile a list of all the charities providing services to your community. Others restrict eligibility to those charities that have met general financial standards. Still others limit participation based on the charities' missions.

Not all workplace giving campaigns use the same criteria for selecting charities. Some simply compile a list of all the charities providing services to your community. Others restrict eligibility to those charities that have met general financial standards. Still others limit participation based on the charities' missions.

Thus, the charities provided to you may not necessarily meet your

giving standards. It is up to you to conduct a review of each charity's

programmatic and financial accomplishments. Start your research by using

Charity Navigator's website to quickly review the Financial Health and

Accountability & Transparency of thousands of America's largest

charities. Look for those charities that are efficient fundraisers,

spend a high percentage of their budget on programs, are steadily

growing their revenue and programs over time, and have enough liquid

assets on hand to survive a crisis. It is also important to note if a

charity is willing to share critical data about their organization-- by

making full and accurate information about its mission, activities,

finance, and governance publicly available, a charity encourages

transparency and accountability to its constituents. Then, either

explore the charity's website or give them a call to learn more about

the organization's mission, goals and accomplishments. Good charities

will be eager to share their successes with you.

4. Find out what percentage of your donation is going to the charities you've chosen.

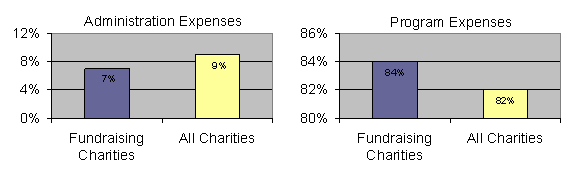

Just as individual charities exhibit different levels of efficiency, so do the fundraising charities that run workplace giving campaigns. Since these organizations exist to channel your money to other charities, they should spend more on programs and less on overhead as compared to other types of charities. In fact, Charity Navigator's analysis shows that the median fundraising charity spends 84% on its programs and only 7% on administrative expenses. Comparatively the median charity evaluated by Charity Navigator spends 82% on programming and 9% on administrative expenses. So before you contribute, make sure that your workplace giving campaign is efficient at funneling donations to the charities it is in business to support.

Just as individual charities exhibit different levels of efficiency, so do the fundraising charities that run workplace giving campaigns. Since these organizations exist to channel your money to other charities, they should spend more on programs and less on overhead as compared to other types of charities. In fact, Charity Navigator's analysis shows that the median fundraising charity spends 84% on its programs and only 7% on administrative expenses. Comparatively the median charity evaluated by Charity Navigator spends 82% on programming and 9% on administrative expenses. So before you contribute, make sure that your workplace giving campaign is efficient at funneling donations to the charities it is in business to support.

5. Maximize the amount of money going to charity by reviewing your employer's matching program.

Many employers will match charitable donations made by their employees throughout the year. Often employers extend these matching programs to include gifts made through workplace giving campaigns. It is important for you to inquire about your employer's matching criteria so that you can maximize the impact of your donation. For example, some employers double the impact of a donation by matching each dollar. That means if you can only afford to give $500, the charity actually receives $1,000. Once you understand your employer's matching plan, you can make the most of your workplace giving campaign and maximize the level of funding your favorite charities receive.

Many employers will match charitable donations made by their employees throughout the year. Often employers extend these matching programs to include gifts made through workplace giving campaigns. It is important for you to inquire about your employer's matching criteria so that you can maximize the impact of your donation. For example, some employers double the impact of a donation by matching each dollar. That means if you can only afford to give $500, the charity actually receives $1,000. Once you understand your employer's matching plan, you can make the most of your workplace giving campaign and maximize the level of funding your favorite charities receive.

6. At the end of the year, find out how your donations were put to use.

You've taken the time to identify a well-managed, responsible charity that works to solve the issues that are most important to you. Over the course of the year you've invested your hard-earned money to support that charity's mission. Now it's time to take stock of that charity's accomplishments. Find out what successes the charity had during the year by reviewing the charity's website, reading its annual report or directly communicating with the charity. Be sure to also inquire as to what challenges the charity expects to face over the coming year.

You've taken the time to identify a well-managed, responsible charity that works to solve the issues that are most important to you. Over the course of the year you've invested your hard-earned money to support that charity's mission. Now it's time to take stock of that charity's accomplishments. Find out what successes the charity had during the year by reviewing the charity's website, reading its annual report or directly communicating with the charity. Be sure to also inquire as to what challenges the charity expects to face over the coming year.

After you're satisfied with your favorite charity's progress, be sure

to continue your commitment to its work. Renew your financial support

through your employer's annual workplace giving campaign, making sure

your contribution qualifies for your employer's matching program. As you

learn more about how your donation advances the charity's mission, you

might even be motivated to increase your involvement in the cause by

donating your time. Charities play a vital role in our communities and

they need both financial donors and volunteers to help them succeed in

making our country a better place to live.

Attention Human Resource Managers and other Workplace Giving Volunteers

Charity Navigator is pleased to provide the following formatted version of this article suitable for you to quickly download and share with your employees. Publishing our guide will help you maximize the level of participation in your annual workplace giving campaign. It demonstrates your company's commitment to responsible philanthropy.

6 Tips to for Workplace Giving (pdf)

Charity Navigator is pleased to provide the following formatted version of this article suitable for you to quickly download and share with your employees. Publishing our guide will help you maximize the level of participation in your annual workplace giving campaign. It demonstrates your company's commitment to responsible philanthropy.

6 Tips to for Workplace Giving (pdf)